What is roof eaves? Does your house need

Mar 27, 2024How to Become a Dump Truck Driver [2024

Mar 13, 2024Why do you need to let your wine

Feb 22, 2024How Whirlybirds Work? How to Decide How Many

Jan 08, 2024What do professionals clean silver with? What should

Dec 29, 2023What is the best flooring to use in

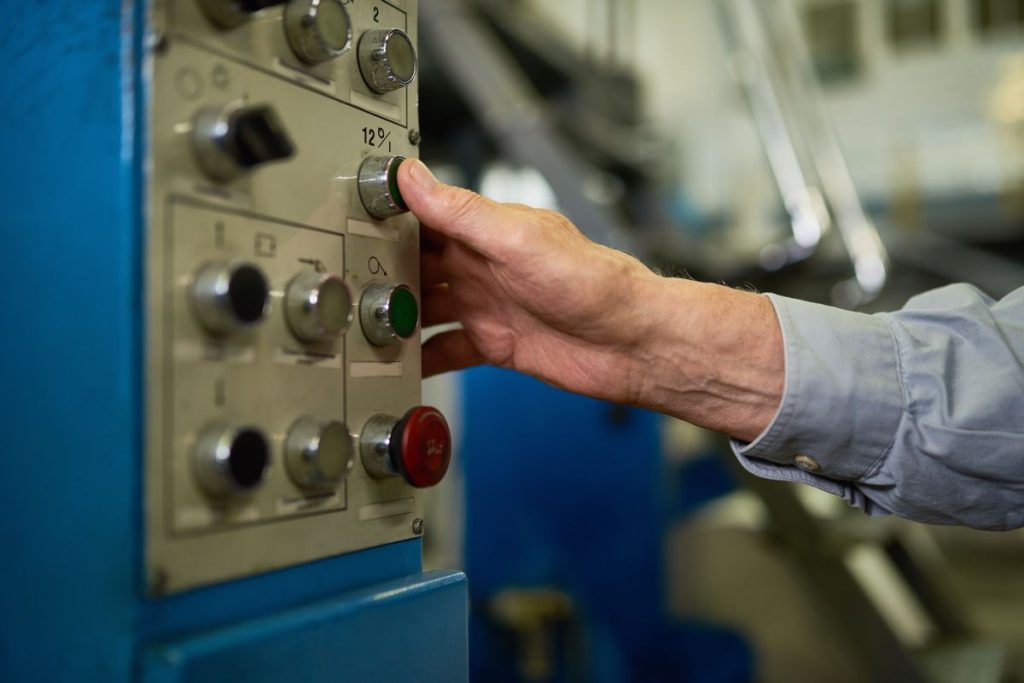

Dec 19, 2023What is a push button switch? What are

Aug 28, 2023How would you describe a good handyman? What

May 23, 2023What are AC and DC in electricity? What

Jan 17, 2023Why is having a clean office important? What

Dec 23, 2022Does home window tint save you money? How

Dec 19, 202210 Easy Travel Tips: How to Make Your

Sep 08, 2022What should I get for my 17th birthday?

Aug 01, 2022What is meant by self-storage? Who started it

May 30, 2022What do suspended ceilings do? What types are

May 23, 2022What are banquet chairs? How wide is a

May 23, 2022What’s the easiest way to migrate to Australia?

Apr 01, 2022Can I put laminate flooring on floorboards? Do

Mar 09, 2022Is painting and decorating hard work? How much

Feb 03, 2022What jobs can a mini excavator do? Are

Jan 13, 2022How can I control pests naturally? How can

Jan 13, 2022Dark Patches Of Skin: Could Tanning Habits Be

Jan 04, 20225 Electrical Safety Tips Everyone Should Know and

Dec 29, 20215 Handy Benefits for Using Blue Vinyl Gloves

Dec 24, 20215 Reasons Why You Need Soundproofing in Your

Dec 22, 2021Enjoy an Easy Life and Leave the Cleaning

Dec 20, 2021The effect of temperature on office productivity

Dec 18, 2021Evolving Illuminance

Dec 16, 2021Quality Custom Made Flight Cases and Why You

Dec 12, 2021Three Essential Accessories for Your 4×4

Dec 10, 2021What is the difference between an arborist and

Dec 09, 2021Things to Consider Before Buying Antique Furniture

Dec 08, 2021Ingenious uses for Candy and Chocolate

Dec 06, 2021The Kitchen Remodelling Philosophies For Australians

Dec 04, 2021For the One You Hold Dearest to Heart:

Dec 02, 2021Tips to Optimise the Performance of Your Car

Nov 30, 2021What is meant by self-storage? Who started it first? Where was the first storage unit built? How long have storage

Self-storage has gone through leaps and bounds in recent years, with the market reaching a whopping $87-billion dollars in the US alone. But where did it all begin?

- Juan Phillips / 2 years

- 0

- 5 min read

What should I get for my 17th birthday? Present ideas for 17-year-old girls and boys

Birthdays can be so much fun to prepare for, thinking about parties, cakes and, of course, gifts! But what should you be asking for on your 17th? And

- Juan Phillips / 2 years

- 0

- 5 min read

Does home window tint save you money? How much does window film reduce heat? What is the darkest window tint

Does home window tint save you money? How much does window film reduce heat? What is the darkest window tint for a home? Click here

- Juan Phillips / 1 year

- 0

- 6 min read

Editors Pick

What do suspended ceilings do? What types are

Sign Up To Recieved News And Updates

In order to access or use DigiLocker, you must agree to the terms of services set out below. By visiting or using the Site, you expressly

Sign Up To Recieved News And Updates

Sign Up To Recieved News And Updates

What is roof eaves? Does your house

What is roof eaves? Does every house need roof eaves? What would it be if my house has no roof eaves? Read this article for more information

- Juan Phillips / 3 weeks

- Comment (0)

Editors Pick

- Juan Phillips / 2 years

- 0

- 5 min read

Can I put laminate flooring on floorboards? Do I need underlay? Is laminate flooring waterproof?

Can I put laminate flooring on floorboards? Do I need underlay? Is laminate flooring waterproof?

- Juan Phillips / 2 years

- 0

- 5 min read

What’s the easiest way to migrate to Australia? Can I move without a skill? What is the maximum age? Can

Dark Patches Of Skin: Could Tanning Habits Be To Blame?

- Juan Phillips / 2 years

- 0

- 5 min read

Can I put laminate flooring on floorboards? Do I need underlay? Is laminate flooring waterproof?

Trending Videos

What do suspended ceilings do? What types are

What do suspended ceilings do? What types are

Dark Patches Of Skin: Could Tanning Habits Be To Blame?

What are banquet chairs? How wide is a banquet chair? How tall is a standard banquet chair?

Todays Topics

What are lab-grown diamonds? Are lab-grown diamonds real diamonds? What

Defence Special

Search

Top Category

World News

What’s the easiest way to migrate to Australia? Can I move without a skill? What is the maximum age? Can

What are banquet chairs? How wide is a banquet chair? How tall is a standard banquet chair?

What should I get for my 17th birthday? Present ideas for 17-year-old girls and boys

Does home window tint save you money? How much does window film reduce heat? What is the darkest window tint

- Juan Phillips

- 04 April 2024

8 Simple Ways to Enhance the Air You Breathe at Home

Improving your indoor air quality can reduce health risks and enhance your overall well-being. Here are 8 tips to helpDark Patches Of Skin: Could Tanning Habits Be To Blame?

What are banquet chairs? How wide is a banquet chair? How tall is a standard banquet chair?

Finally found a work computer setup That’s practically perfect

15.20.2022 / Jimmy GomezFinally found a work computer setup That’s practically perfect

15.20.2022 / Jimmy GomezFinally found a work computer setup That’s practically perfect

15.20.2022 / Jimmy GomezFinally found a work computer setup That’s practically perfect

15.20.2022 / Jimmy GomezPopuler News

Online Voating

This may be the latest case of post aggression emigration in Ukraine. But it is unlikely to be the final stage for millions of people to leave the country. These people do not want

NEWSLETTER SIGN UP!

For information Consult with our expert members